More and more Indians are starting to finance their goals by opting for personal loans. A whopping 96% of new loans taken in 2018, were personal loans, as per data from RBI.(1)

The easy availability of such loans, the lack of collateral, and attractive interest rates are some of the major contributing factors to the rapidly growing popularity of personal loans. When you apply for a personal loan, it is fair to expect an interest rate anywhere from 9% to 20%, depending on the financial institution. But that’s not all. With certain carefully practised tips and tricks, you can easily lower your interest rates.

Here’s how:

- A healthy credit score: A CIBIL score of 750 or above is your ticket to securing an instant personal loan at competitive rates in the future. A few ways to achieve this include avoiding approaching banks directly with loan and credit card application, regularly monitoring a co-signed loan to make sure payments are made on time and not taking credit exceeding your overall credit limit. It is important that your credit utilization ratio stays under 30%. Make sure to regularly check your credit information report to know that you are on track, as well as keep a fair proportion of both secured and unsecured loans in your portfolio. Loan default such as a missed or delayed payment should be avoided at all costs.

- Repay on time: When you apply for a personal loan, make a decision to pay your EMIs before the due date or on time, but never delay or miss an installment. Similarly, when you make a credit card transaction, remember to make timely bill payments so that any debt is cleared as soon as it accumulates. This habit can help you get attractive personal loan interest rates in the future, because most lenders are on the lookout for individuals with a good history of repayment.

- Stay aware of the market: Do your own research on which bank or financial institution offers lower interest rates as compared to others, before you zero upon the final lender. A bank with an existing relationship with you might be eager to offer competitive rates and faster processing. Also keep an eye out for festive offers when interest rates might be less and you can save on the cost of the loan.

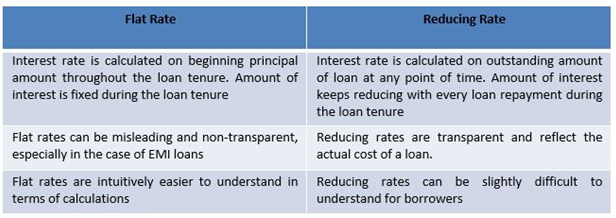

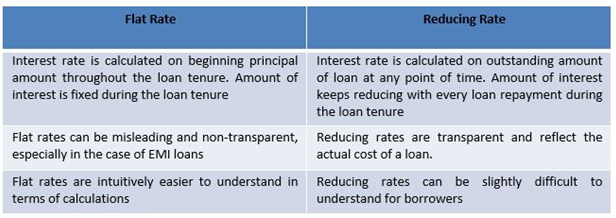

- Understand how interest is calculated: Avoid taking interest rates at face value. Always try and understand the method by which interest payable is calculated. A reducing interest rate should be preferred over a flat interest one. In the former, interest is calculated on the outstanding principal, while in the latter, the total loan amount is taken into consideration while calculating interest. While you may you end up paying more in the flat interest method, your EMIs would keep getting lesser in the reducing interest rate method.

- Your employer: Working with a Fortune 500 company or an MNC? You might find it easier to get an instant personal loan as compared to someone who is working with a start-up or is an entrepreneur. This is because the credibility of your employer positions you as someone with a stable source of income. Since you have a steady job, a lender believes that you will be able to repay the debt on time or even earlier.

- Be employed for 2 years or more: Your job stability can be an important factor for a bank to offer you attractive interest rates. It is not uncommon to see those employed long term with state or central government organisationsor PSUs being offered lower personal loan interest rates as compared to others. This is because they are bound to get a fixed income every month that makes them more financially able to repay the loan on time.

You can also apply for a personal loan, on Finserv MARKETS and avail attractive interest rates starting at 12.99% per year. So whether you want to live your travel dream, renovate your home or finance your son’s higher education, personal loans of upto ₹25 lakhs can be easily availed.

The application process is online, paperless and transparent, with no hidden charges. To apply for a personal loan, simply head to Finserv MARKETS, fill a form with your personal and employment details, specify the loan amount and repayment period and upload a few documents.Get your customizedpersonal loan approved in flat 3 minutes and credited to your account in 24 hours after that!